Another municipal land transfer tax Increase for properties purchased at over $3M.

Monday Dec 29th, 2025

Another municipal land transfer tax Increase for properties purchased at over $3M.

On April 1, 2026 the buyers of residential properties in Toronto valued at over $3M will be faced with increased land transfer tax.

As of January 1, 2024, the City of Toronto introduced initial increase of the land transfer tax for luxury properties.

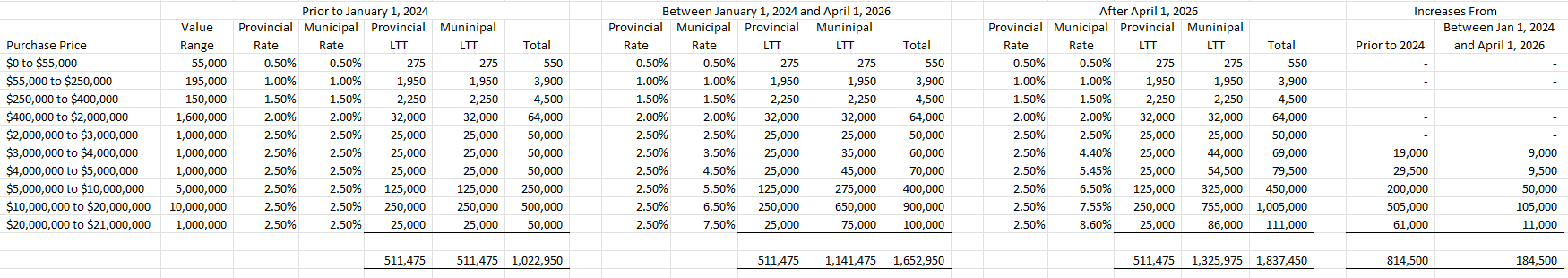

The second tax increase will work on a graduated scale as follows:

- Homes valued between $3 million and $4 million would see a 0.9 per cent change in rate, to a total 4.40 per cent.

- Homes valued between $4 million and $5 million would see a 0.95 per cent change in rate, to a total 5.45 per cent.

- Homes valued between $5 million and $10 million would see a one per cent change in rate, to a total of 6.5 per cent.

- Homes valued between $10 million and $20 million would see a 1.05 per cent change in rate, to a total 7.55 per cent.

- Homes valued above $20 million would see a 1.10 per cent change in rate, to a total 8.6 per cent.

Only a handful of properties sold sell for more than $20 million, sales over $3 are a small percentage of overall sales, yet still with approximately 1,000 transactions at over $3 million per year, the totals collected is not insignificant.

The table below illustrates the changes in the municipal land transfer tax increases since 2023 for affected price brackets up to $21 million.

Please let us know if you have any questions.

Post a comment