First Home Savings Account (FHSA) was first announced in 2022 and is finally available as of April 1, 2023.

In this article we will summarize the main aspects of this program and go into details further down, if you have a question that hasn’t been answered just drop us a line.

As a general comment, the federal government has been recently introducing other programs such as The First-Time Home Buyer Incentive which flopped miserably and gained almost no traction, on the other hand the FHSA looks like a fantastic program for the first time home buyers, and judging by the response it got so far it will be very popular.

FHSA Summary – the main features.

Annual contribution limit of $8,000 per individual.

Lifetime contribution limit of $40,000 per individual.

Can be opened for up to 15 years since the first FHSA account was opened.

Unused contribution room carries forward.

The contributions are tax deductible (just like the RRSP contributions).

The contributed amounts don’t have to be paid back into the program (unlike RRSP HBP).

Income earned inside the FHSA is tax-free.

Multiple FHSA accounts can be opened across multiple financial institutions.

Funds from FHSA can be transferred on tax-free basis to RRSP or RRIF without affecting the RRSP contribution room. Funds from FHSA can’t be transferred to TFSA on tax free-basis.

Funds from RRSP can be transferred to FHSA on a tax-free basis.

FHSA can be used together with RRSP HBP for the purchase of the first home, initially CRA stated it was either or, this was later amended.

Spousal contributions are not permitted.

FHSA details.

Who qualifies?

In order to qualify for FHSA the person must be 18 years or older, be a Canadian resident, and be a first-time home buyer.

The individuals can open the account the day they turn 18 years old, and the contribution room for that year will not be prorated, it will be $8,000.

A first-time home buyer is an individual who didn’t own and didn’t occupy the property as a principal residence (individually or jointly owned, or a spouse or common-law partner individually or jointly owned) at any time during the four proceeding calendar years of the opening of the FHSA account. It means that one could have owned a property but not lived there (rental for example) and still qualify as a first-time home buyer.

Qualified home.

The properties that qualify are detached and semi-detached homes, townhouses, condominium units, apartments in duplexes, triplexes, fourplexes and apartment buildings and mobile homes. A share that gives a right for the tenancy of the unit does not qualify, however a share in co-operative housing corporation that entitles the taxpayer to possession and equity interest on a housing unit located in Canada does qualify for FHSA.

FHSA and precons.

FHSA can be used to purchase the preconstruction condos or freeholds even if the contract was signed prior to April 1, 2023, as long as all other conditions are met.

Where to set up FHSA account?

In all likelihood most if not all financial institutions will have the option to open the FHSA account, as of the time of the writing many of the well known companies such as Questrade, Fidelity, Wealthsimple, all big five banks either have the product already available or will have it available in the coming weeks or months.

What type of investments can be held inside FHSA?

All typical investments such as saving accounts, GIC, mutual funds, stocks, bonds and so on, it can be self-directed or managed.

When to close the FHSA account?

The account must be closed at the earliest of the following:

- December 31st the year following the qualifying withdrawal was made.

- December 31st following the 15th anniversary of the account opening.

- December 31 following the year the individual turns 71 years of age.

Contributions.

There is an annual contribution limit of $8,000, and a lifetime contribution limit of $40,000, per person. If a couple is buying a property each one can contribute up to $40,000 and if the investments grew on a the tax free basis inside the plan they can potentially withdraw tangibly more than that for the down-payment on the house.

An individual can open one or more FHSA accounts, the contribution room applies to all accounts, not an individual account.

Contributions must be made within the calendar year in order to be claimed on the tax return for the year, unlike RRPS where the contributions can be made up to 60 days after the end of the calendar year.

Minimum Holding Period.

Unlike with RRSP HBP, there is no minimum time period required to be held within FHSA in order to be considered for the qualified withdrawal.

Transfers between FHSA and RRSP(RRIF).

Transfers can be done from RRSP to FHSA on the tax-free basis, transfers from RRSP to FHSA affect the FHSA contribution room. If for example, someone transfers $5,000 from RRSP to FHSA the remaining annual contribution room will be $3,000 ($8,000-$5,000) and the remaining lifetime contribution room will be $35,000 ($40,000 - $5,000). Transfers from RRSP to FHSA in excess of the FHSA contribution room will create tax consequences.

Any amounts transferred from the RRSP will not create any tax deductions, nor will they increase or restore the RRSP contribution room.

Form RC720 is to be used for the transfers from RRSP to FHSA.

Transfers from FHSA to RRPS or RRIF can be done on the tax-free basis providing there are no excess FHSA amounts, and will not affect the RRSP contribution room. Excess amounts upon transfer will be added to the income in the year of the transfer. Excess FHSA amounts transferred to RRSP or RRIF will reduce the contribution room for these retirement plans.

The forms to transfer from FHSA to RRSP are not available as of the time this blog was written.

Transfers from a spousal RRSP to FHSA are permitted except when the spouse (including common-law partner) has contributed any amounts to any spousal RRPS in the year and two preceding calendar years.

Proper forms must be filled to ensure the transfers are done without triggering tax consequences, just withdrawing and depositing into another plan will trigger taxes and reduce the contribution room. This applies to transfers between FHSA and RRSP(RRIF), as well as transfers between different FHSA plans (transfer forms will be available later on during the year).

Direct transfers from RRIF to FHSA are not permitted.

There are no direct transfers between FHSA and TFSA, meaning any transfers are treated like regular withdrawals from these plans.

Withdrawing from FHSA.

There are three types of withdrawals.

Qualifying withdrawals for the purchase of the house.

When all the conditions are made the funds can be withdrawn from FHSA on a tax-free basis.

In order to qualify for a tax-free withdrawal all of the following conditions must be made:

- Must be a first-time home buyer.

- Must have a written agreement of purchase and sale with a completion date no later than October 1 of the year following the date of the withdrawal.

- Must be a resident of Canada from the time the withdrawal is made until the acquisition date or death.

- The acquired property must have been purchased no more than 30 days prior to making the withdrawal, in other words, the funds must be drawn within 30 days after the closing date.

- You must occupy or intend to occupy the property within one year of purchasing or building it.

If one of the above conditions is not met the withdrawal will be a treated as non-qualifying withdrawal and trigger a taxable event.

Form RC725 must be submitted to the financial institution in order to facilitate the qualifying withdrawal, and the account should be closed by December 31 of the year following the year the withdrawal was made.

Designated withdrawal.

A designated withdrawal is one where there is an excess contribution made to the plan and to avoid further penalties on the excess contribution the designated withdrawal is made.

Taxable withdrawal.

If the withdrawal does not qualify as designated nor qualifies withdrawal, it will be a taxable withdrawal and the amount will be added to the income on the tax return in the year it was withdrawn. The withdrawal will be subject to income tax withholding at the time of withdrawal (similar to RRSP) and taxed at the marginal rate of the individual.

Limitations.

- Contributions you make to your FHSA during the first 60 days of the year cannot be deducted on your income tax and benefit return for the previous year, unlike contributions to RRSP.

- Contribution made after the first qualifying withdrawal cannot be deducted on your income tax and return for any year.

- An excess FHSA amount designated as withdrawal cannot be deducted on the income tax return.

- If you have an excess FHSA amount after your maximum participation period has ended and you have not reached your lifetime FHSA limit of $40,000, you may not be able to deduct all of your unused FHSA contributions. This is because after your maximum participation period has ended, your annual FHSA limit is $0.

- Any contribution in excess of the lifetime limit of $40,000 cannot be deducted on the income tax return.

Tax deductions on the contribution.

The contributions can be deducted in the year they were made or can be carried forward to future years. The eligibility of the contributions to be claimed is based on the calendar year, unlike in the case of the RRSP the contributions made up to 60 days after the year's end can be claimed in the previous year. For example, if a contribution to FHSA is made on January 5, 2024, it will be claimed on the 2024 tax return and not on the 2023 tax return.

Contributions made after the first qualified FHSA withdrawal can never be claimed as a deduction on the tax return.

Unused contributions can be carried forward beyond the closure of the FHSA accounts and can be claimed as a deduction on the tax return in future years.

If the accounts are not closed after FHSA ceased its eligibility the FMV of the investments must be declared as income.

Excess contributions penalties.

1% tax per month is applied to the excess amount until the excess amount is eliminated. The excess amount can be eliminated by increased contribution room starting January 1 of the following year, designated transfer or withdrawal, a taxable withdrawal, or by including it in the income when the FHSA account loses its status.

Interest deductibility for borrowing to contribute to FHSA.

Interest expenses incurred to borrow for the FHSA are not tax deductible, and neither are the losses on investments incurred inside FHSA.

Non-residents.

Only residents can open FHSA account, if a person becomes non-resident after the account was already opened he or she can continue participating in the program but can’t make a qualified withdrawal. Any withdrawal will be subject to a 25% withholding tax unless specified otherwise by a treaty.

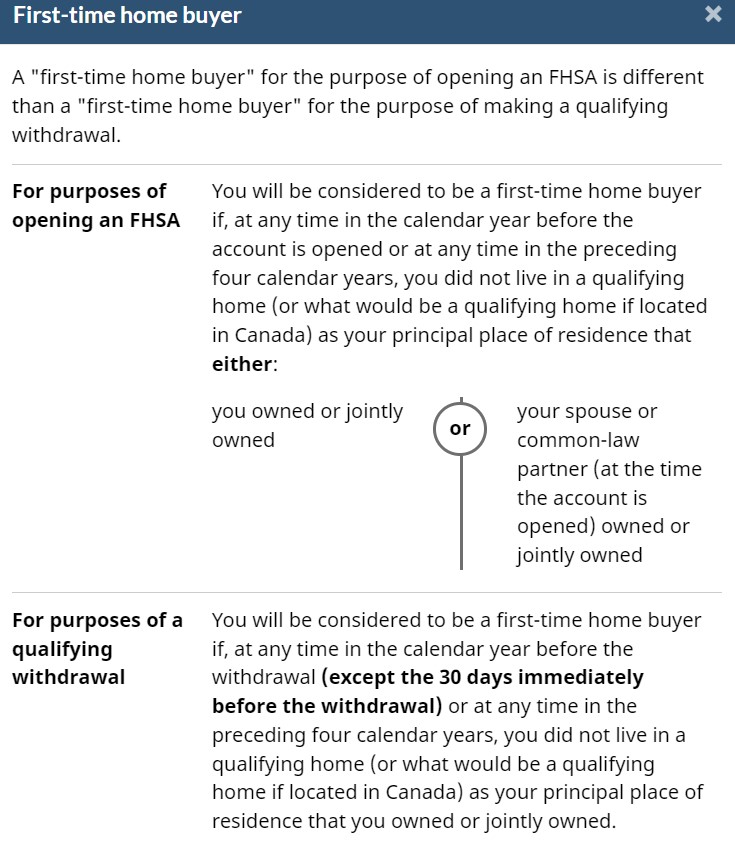

Definition of first-time home buyer for the purpose of contribution to the FHSA and for the purpose of the withdrawal from FHSA.

The definition is not the same for both situations, please see the image below illustrating the variance.

FHSA comparison to TFSA and RRSP HBP.

The FHSA complements both TFSA and RRSP HBP, it shares some similarities with them but also has significant differences. FHSA can be utilized in conjunction with the other two plans as part of the funds withdrawn toward the purchase of the first home. The withdrawals don’t have to be used for the down payment or anything related to the house but must be withdrawn correctly and meet the criteria of each plan.

FHSA versus TFSA.

Differences: TFSA has annual contribution limits but no lifetime contribution limit, designed for saving money for any purpose and can be withdrawn for any reason, contributions are not tax deductible. TFSA withdrawal can be replenished by creating an additional TFSA room, FHSA can’t. FHSA can be opened for up to 15 years.

Similarities: qualified withdrawals are not taxable, funds don’t have to be paid back, the unused contributions room can be carried forward.

FHSA versus RRSP HBP.

Differences: RRSP is intended to save for the retirement, but HPB offers a provision to help with the down-payment on a first house. RRSP HBP has to be repaid within 15 years or it will be added to the income. FHSA contributions must be made within the calendar year, and RRSP contributions can be made up to 60 days after the end of the year in order to be claimed in the previous year. FHSA can be opened for up to 15 years.

Similarities: both plans offer tax deductions when contributions are made, and the unused contribution rooms can be carried forward.

Overall we think FHSA is a very good program to help the first-time home buyers to save money for the purchase of their first home.

Please let us know if you have any questions regarding this or any other topics.

Sources:

CRA – First Home Savings Account (FHSA).

Post a comment