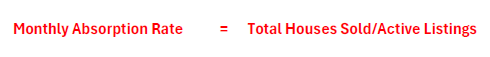

An absorption rate is a measure of evaluating the strength of the real estate market by calculating the number of properties sold (usually within a month) versus the number of properties available for sale at the end of the period. The higher the number, the stronger the market. The calculation shows how long it would take to sell all the current inventory available for sale given the current market conditions.

For example, we have 1,000 active listings, and within the last month 200 were sold, the absorption rate is 20%.

If we still have 1,000 active listings, and within the last month 400 properties were sold, the absorption rate is 40%, much higher than in the first example, and the market is much stronger.

The absorption rate can be calculated for all property types, different types of properties, regions and areas and so on.

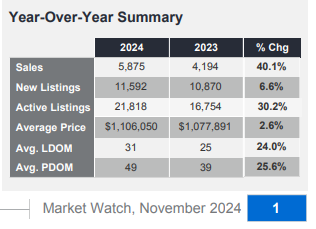

Let’s have a look at the actual examples in GTA, for November 2024 and November 2023 for comparison, based on the November 2024 Trreb report.

By all accounts in terms of GTA’s real estate market both November 2024 and 2023 were weak markets.

In November 2024 we had 5,875 sales and 21,818 active listings, therefore the absorption rate for the month was 27% (5,875/21,818).

In November 2023 we had 4,194 sales and 16,754 active listings, therefore the absorption rate for the month was 25% (5,875/21,818).

Based on the absorption rate the market in November 2024 was slightly stronger than the previous year, the main difference was we had much higher sales and listings, but the ratio of sales to active listings shows a small improvement.

Let’s calculate the absorption rates for few other periods, first for July 2024.

July 2024 had 5,391 sales and active inventory of 23,877 units, giving as an absorption rate of 23%, expected low number since the market in July was very weak.

February 2022 was extremely strong market, what we consider a peak of craziness around GTA, Trreb report shows as follows: 10,929 sales, 8,727 active listings, absorption rate of 125%. Not surprisingly, given the insanity of the market at that time.

Absorption rate is a metric very similar to Months of Inventory which we explained previously, it’s actually inverted MOI expressed in percentage, for MOI the lower the number the stronger the market, the higher the absorption rate the stronger the market.

You may find online different opinions of what is considered a buyers, sellers and balanced markets, since GTA’s real estate market has been quite strong over the last 3 decades we consider the absorption rates of 33% or more to be sellers’ market, 20% or less to be the buyer’s market, and between 20-33% to be the balanced market.

Hope this blog will help you understand the absorption rate in real estate. If you have any questions regarding this, or any other real estate topic, don’t hesitate to contact us.

Post a comment