You have found a nice and inexpensive piece of land and decided this is where you want to live, perhaps not only is it a great place for you to call home but also a fantastic investment.

Great, now slow down, a lot of research should go into the decision making before dumping your hard-earned money into it, as there will be many hurdles to overcome, and many questions to answer:

Question 1.

Can I build a house on this piece of land?

This will depend on several factors, there will be number of organizations to contact:

- Town and municipality, you will need to ensure the government will allow for the construction (zoning, regulations, by-laws, future planning etc.)

- Conservation authority, if the land is under conservation authority you will need to ensure such authority will permit the construction.

- Historical authority, in a historic district you will be limited to what you can do on the property.

- Other, there are other authorities which can limit or actually stop you from building a house on the land (archeological, geological, environmental are just a few aspects which can bring your project to a halt).

- On many properties no housing can be built, making them unsuitable for that purpose.

Question 2.

Can I build a house I want on this piece of land?

You have now established that you can build a house on this property, now is the time to determine if you can construct the house you want. This will depend on many factors, and all of the above authorities will have to be contacted to ensure you comply with regulations, zoning, and so on. One of the more common issues of buying a parcel in or close to urban areas is the size, if the size of the land is small you may not be able to build the big enough house, or there may not be enough room for the pool you always wanted. Some areas will permit only multi-housing, others may only allow detached houses.

Question 3.

What are the development charges?

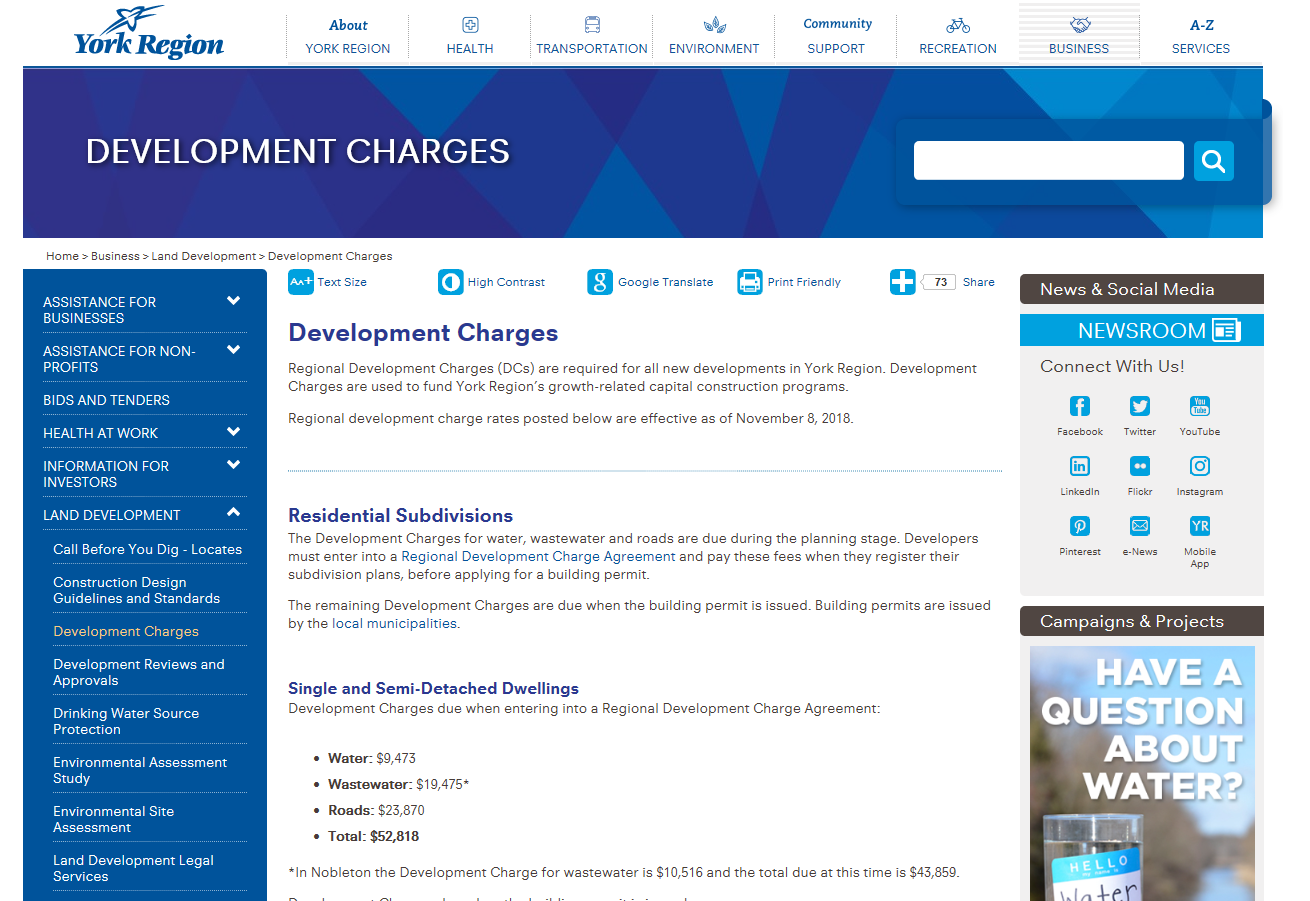

Every municipality is hungry for revenues, and with every new house built there will be development charges, and even for a single detached house the fees, depending on the municipality, can be very high. York region for example has increased their development charges to $52,818 per unit and this is just the beginning, you will still need to worry about connecting hydro, gas, water, road (if applicable), in total this can set you back $100,000 or even more before you even apply for a permit.

Question 4.

Can I sever the land into smaller parcels?

Again, you need to check with the municipality, in general if this was easy to do the seller would have done it already, and if it is possible it can be very expensive and time consuming.

Question 5.

What are the nearby properties zoned for and future developments?

At the moment you may see nothing but nature and forests, but what if there are plans to build an airport, factory, highway, hospital or a subdivision? Check with the planning department for their short and long term plans.

Question 6.

What utilities are available?

Will I have gas, water and sewage supplied by the Town, or will I have to build by own septic tank, drill a well or rely on the green energy to run the electricity. How far are the hookups? The longer the connection the more it will cost you.

Question 7.

Is the lot flat or on the hill, what is the soil condition, are there any water issues, streams?

Flat lot will be much less expensive to build on, water flowing into the property will create many challenges, soil conditions can greatly impact the foundation.

Question 8.

How convenient is the property?

The lot may look great in the summer, but what will it offer in the winter, will the roads be maintained, how far do I have to drive to get groceries, what is available in the neighbourhood (shopping center, hospital, schools)? Does the property fit not only my lifestyle, but the lifestyle of every family member, young and old?

Question 9.

Do I have enough funding to finance the project?

To build a home on an empty lot large financing will be required, and it is very different for getting a mortgage on a house, please consult a professional mortgage broker for advice.

You have done all the due diligence, found the land and everything checks off, congratulations and good luck, but what if it is more than you bargained for, are there alternatives? In short, the answer is yes.

Buy a tear down.

With a tear down, you will still have an opportunity to enjoy a brand new house, and the benefits are as followed:

- You will not have to worry about not being able to build a house, the house is already there and unless there are special circumstances the municipality will allow you to build a house of the same size, and you can apply for a minor variance to change the dimension, location of the house on the lot etc.

- You will not have to pay development charges as they are usually for empty lots only.

- You will already know what services are available to you since the existing house would have been heated, had water and sewage system.

Buy a fixer upper.

Another option is a fixer upper, still a challenging proposition, yet on a lesser scale.

Whatever you choose please ensure the due diligence is done for each property you are considering, one glove doesn’t fil all and even with neighbouring properties you can face different challenges and obstacles.

Post a comment