In the past we have written a blog providing a basic insight into the condo fees to explain why condo fees are so expensive.

Before we dive into more details let’s recap some aspects of the condo fees:

- The fees for condo apartments are typically much higher on a per square foot basis than condo town homes as long as the town homes are not attached to the condominium building.

- Units with parking and locker will have higher fees than identical units in the same condo corporation as units without parking or locker since the fees for these are calculated separately. A monthly fee for parking can be quite high depending on the building.

- Some units will have all or some utilities included (water, heat, hydro), while others will not. Some newer condos have internet included in the monthly fees.

- Older condos will typically have higher monthly fees on a per square foot basis than newer condos, although recently we noticed a trend where new buildings start with already fairly high fees.

- For new condos one can expect higher monthly fee increases in the first few years.

- On average it is more expensive to maintain a freehold property, but on a per square foot basis it is typically more expensive to maintain a condo.

- Condo owners pay for many services that freehold owners typically don’t (management, accountants, engineers, concierge, office expenses, consultants and so on).

- Freehold property owners have much more control over what, how and when the maintenance is done, can do multiple tasks themselves, condo owners don’t have the control since everything outside of their unit is outsourced.

- Smaller condos may have higher condo fees on average, especially if they have a concierge.

- Low condo fees don’t mean the building is properly maintained, it is important to check the financial position of the corporation, reserve fund statements, auditors comments, and have a general feel of how the building is maintained. Keeping the monthly fees artificially low could lead to higher expenses, special assessments, loans, and in general financial difficulties down the road.

- Condominium corporations are not for profit entities, while the corporate income tax filings must be done every year there is no tax be paid, the estimated annual budget and monthly fees should be enough to cover all the expenses without significant profit or deficiency.

- Condo fees in Toronto and GTA are typically higher than elsewhere.

How much is the maintenance fee for the parking space?

That depends on the building, the overall footprint, age of the building, location. For example, a brand new high rise condo with a very narrow footprint will typically have higher maintenance fees for the parking spot than older building with a wide footprint.

Let’s look at some actual examples:

- 10 year old condo in King West (over 250 units) – monthly parking maintenance of $83.

- 20 year old condo in Moss Park (around 200 units) - monthly parking maintenance of $53.

- 5 year old condo in Church-Yonge corridor (over 450 units) – monthly parking maintenance of $87.

- 5 year old condo in Midtown (over 600 units) - monthly parking maintenance of $220.

Logically one could expect the older buildings to have higher maintenance fees for the parking spaces but that’s not the case, in general, the parking fees are usually somewhere between $50-100 per month, but can be quite a bit higher for some newest super tall and skinny buildings. Parking fees don’t change with the size of the unit, in the same building a 500sf unit will have the same maintenance fee for parking as the 1500sf unit. The exact same unit in the same building, except one has parking and the other does not, the one with parking will have higher total monthly fees.

Locker fees are usually lower in the $20-30 per month range, yet again new high-rise condos can have locker maintenance fees exceeding $50.

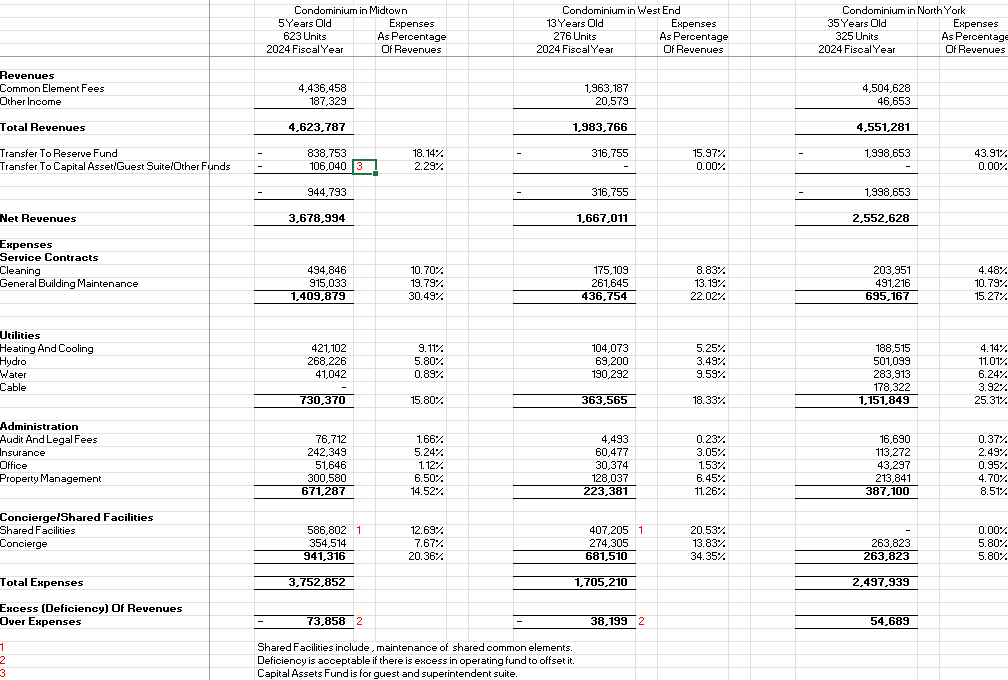

Now let’s dive into the breakdown of expenses in relation to the monthly fees, also based on actual examples of 3 Toronto condominiums. Selected are three different condos, from new to quite old, and different sizes.

Not surprisingly the reserve fund contribution is one of the biggest components of monthly fees, and not surprisingly the oldest building has the highest percentage allocated to the reserve fund. Why are the contributions so high? High-rise condominiums are much more complex than low rise freeholds, cost of window replacement in a house may be $2K, in a condominium the windows must meet different specifications, they are much more expensive, much more difficult to replace especially for skyscrapers, and there are only a handful of companies capable of doing so, the owners can’t replace the windows themselves even if they knew how.

Cleaning expense ranges between 5-10% of the total fees, majority of freehold owners clean their own property, ongoing current maintenance is often done by the freehold owners as well, or they hire someone to do so. They have the flexibility to hire a well-established company or someone from the marketplace. In condominiums this flexibility doesn’t exist, the companies hired to do the task have employees, payroll taxes to pay, and they still want to make a profit.

Utilities are a big item as well, ranging between 15-25%.

The often talked about insurance expense runs between 2-5%, not as big of an item as many would think.

On top of these there are expenses usually not directly applicable to freehold owners, concierge (5-15%), shared facilities (0-20%), management company (5-7%) and other such as office, accounting and legal services.

In summary, when owning a condominium, the owners must pay for many expenses the freehold owners don’t have to, many of the components of condominium are much more expensive to replace, the owners lose flexibility and control on how and when the maintain the property, and that’s assuming the condominium is well managed without any special assessments or fraud. Easy to see why the fees are so expensive while keeping in mind the overall cost to maintain a condo is usually lower than freehold, but per square foot is much more expensive. Condominiums offer convenience, but at a cost.

Current trends (2022-2024).

Currently the fees are increasing at a higher rate than in the past. Prior to covid the monthly fees for well-run established condos would have increased along the lines of inflation around 2-5% annually, the reserve fund increases were typically in the 5-10% range.

Condo nexus, a platform for condominium managers, recently published a summary of trends regarding the monthly fees and some of its components. The report is based on 103 condominiums (not a large number considering there are approximately 12,000 condo corporations in Ontario, most of which are in GTA) indicates the largest increases were in 2022 at 6.7% average followed by 2023 average of 5.1% and 3.3% increase in 2024.

We look at many status certificates each year, more than 100 per year, and we agree the largest jump was in 2022 followed by figures stabilizing in 2023 and 2024, but we still see many condos having currently increased the fees in excess of 5%, and quite a few in excess of 10%.

Per Condonexus the reserve fund increases were on average 8.7% in 2022, 11.8% in 2023, and 13% in 2024, very alarming trend. Our own observations agree with the trends posted in the report; we see many recent reserve funds studies increase double digits per year. We believe it’s related to the tremendous increase in labour and material costs as well as the fact the reserve fund studies are done every 3 years and the engineers are now catching up to the industry related inflation.

In September 2024, Condominium Authority of Ontario, published even more detailed and in-depth report on the reserve fund studies based on the answers from 724 condominiums and 5,986 individuals. We would encourage anyone interested in the topic to download and read the report (please see the link above), however if you don’t have the time or desire to read 38 pages, here is a quick summary:

- Two thirds of the respondents reported the reserve fund contributions in excess of 30% of the monthly fees.

- Special assessments and loans are on the rise triggered by construction costs increases.

- Between 2018 and 2023, 16% of the condo corporations reported special assessments, and 3% reported seeking loans, to fund the reserve fund.

- Assumptions regarding future inflation have increased.

- A large percentage of corporations reports reserve fund study increases at over 6%.

- 6% of the corporations reports increases of over 30% (our comment – such high increases are only acceptable for brand new condos, majority of the condos surveyed were not new, if indeed the sample size is a good reflection of all condos in Ontario, we have a big problem on our hand).

- 79% responded that the contribution meet or exceed the recommended amount, 21% reporting less is further to be investigated as it may contain error in reporting.

- 63% of the unit owners contribute more than $2,000 per year to the reserve fund.

- Toronto has the highest amount per unit contributed to the reserve fund at $4,137, much higher than Central Ontario ($2,466), Eastern Ontario ($2,519), Northern Ontario ($2,004) and Western Ontario ($1,865).

There you have it folks, hopefully this blog will help you further understand what is happening with the monthly condominium fees.

Post a comment